Corporate Income Tax (CIT)

All companies that are tax residents of Cyprus are taxed on their income accrued or derived from all sources in Cyprus and abroad.

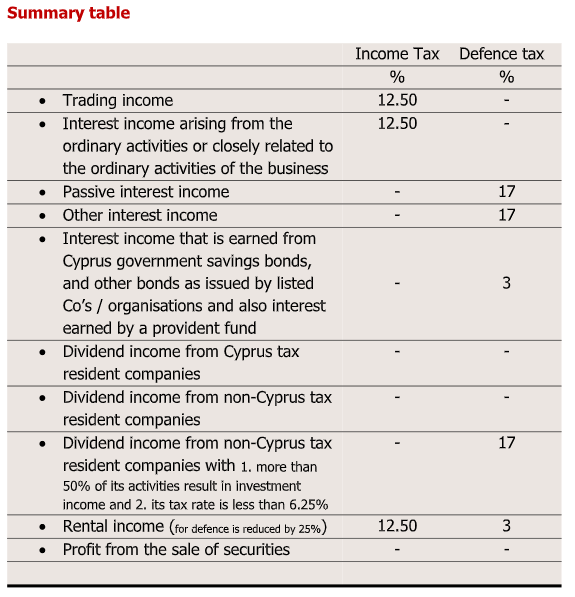

The standard CIT rate in Cyprus is 12.5%.

Interest received by companies in the ordinary course of their business, including interest closely connected to the ordinary course of business, is also considered as ‘active’ interest income and is only taxed under CIT (after deducting allowable expenses) at the standard CIT rate of 12.5%.

Passive interest income

When companies receive interest not in the ordinary course of their business, the interest is considered to be ‘passive’ interest income, which is subject to SDC(without expense deduction) at the rate of 17%. Such ‘passive’ nature interest is, however, exempt from CIT.

As of June 2022, interest income earned from (i) Cyprus government bonds, (ii) Cyprus and foreign corporate bonds listed on a recognised stock exchange, and (iii) bonds issued by Cyprus state organisations or by Cyprus or foreign local authorities listed on a recognised stock exchange shall be subject to SDC at the reduced rate of 3%.The reduced rate of 3% also applies to pension funds.

Dividend Income

Dividends received from other Cyprus tax resident companies are exempt from all taxes, subject to certain anti-avoidance provisions.

Dividends earned from foreign investments are exempt from CIT in Cyprus, with the exception of dividends that are deductible for tax purposes for the paying company. Such deductible foreign dividends are subject to CIT and are exempt from SDC. Other (i.e. non-deductible) foreign dividend income is also exempt from SDC (participation exemption) unless:

- more than 50% of the foreign paying company’s activities directly or indirectly result in investment income, and

- the foreign tax is significantly lower than the tax burden in Cyprus (i.e. an effective tax rate of less than 6.25%).

In those cases where the above-mentioned Cyprus participation exemption on foreign dividend income is not available, any foreign WHT imposition on dividends paid to the Cyprus company will be credited against the Cyprus flat SDC rate of 17% on such dividends, without the need for a DTT to be in place with the paying jurisdiction. Furthermore, in some cases, a credit for underlying foreign tax (i.e. foreign tax on the paying company’s profits) is also available.

Gross Rental Income

Gross rental income reduced by 25% is also subject to SDC at the rate of 3% (i.e. effective rate of 2.25%) in addition to CIT (after deducting allowable expenses) of 12.5%.

Capital gains

Profits from disposals of corporate ”titles” are unconditionally exempt from CIT.

”Titles” are defined as shares, bonds, debentures, founders’ shares, and other titles of companies or other legal persons incorporated in Cyprus or abroad and options thereon. According to a circular issued by the Cyprus tax authorities, the term includes, inter alia, futures/forwards on titles, short positions on titles, swaps on titles, depositary receipts on titles, repos on titles, units in stock exchange indices on titles, and units in open-ended or closed-ended collective investment schemes (including, inter alia, undertakings for collective investment in transferable securities [UCITS], investment trusts and funds, mutual funds, and real estate investment trusts [REITs]).

Capital gains on Cyprus-situated immovable property (and on non-quoted shares directly or indirectly holding such Cyprus-situated immovable property) are taxed separately in Cyprus.